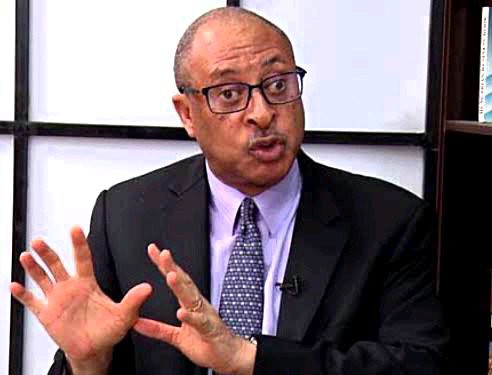

Renowned Nigerian economist and public intellectual, Pat Utomi, has taken to his verified Twitter account to express his disappointment and frustration over the actions of former Ogun State Governor, Ibikunle Amosun, particularly regarding contract violations and the broader implications for governance and investment in Nigeria.

Utomi’s comments have sparked a conversation about the damaging effects of political transitions on business agreements and the overall investment climate in the country.

In his tweet, Utomi disclosed that it was Amosun’s violation of contract terms signed by his predecessor that led to the unfortunate seizure of jets from the Presidential fleet, a move that he described as a source of shame for Nigeria. He lamented that the fallout from Amosun’s actions extended beyond just the Chinese investors, who were among the victims. Utomi revealed that one prominent indigene of Ogun State allegedly committed suicide as a result of similar actions by Amosun, highlighting the devastating human cost of such political decisions.

Utomi did not just comment on the general impact of Amosun’s policies but also shared his personal experience. He recounted how he had leased land from the Ogun State Property and Investment Corporation (OPIC) in Lagos through a Build-Operate-Transfer (BOT) agreement under the administration of Governor Gbenga Daniel. However, upon Amosun’s assumption of office, all such agreements were halted. Despite multiple attempts to resolve the matter, including meetings with Amosun and other political leaders like APC National Leader Bola Ahmed Tinubu (BAT) and former APC Chairman Chief Bisi Akande, Utomi’s case remained unresolved.

In a detailed account, Utomi shared how Amosun had initially indicated a willingness to refund what he had paid, suggesting that Utomi make a claim for ₦100 million and request additional payments afterward. Despite Amosun’s assurances and even a personal drive back to Lagos with the former governor, the issue dragged on for years, eventually leading to the collapse of the project. Utomi’s South African partners, who had invested ₦200 million alongside the lease amount, were forced to abandon the project, causing Utomi to shoulder the financial burden and repay loans.

Reflecting on the broader implications of this ordeal, Utomi drew parallels with similar incidents involving foreign investors, particularly in Enugu, where political transitions led to the disruption of business agreements. He highlighted how these experiences are documented in his new book, “Power Policy Politics and Performance”, emphasizing that such actions by politicians not only deter foreign investment but also undermine trust in the system….Vîêw–Morê